Home Equity Loans

Want to leverage your home equity to accomplish financial goals? Approved Cash can help you get there.

Home Equity Loans Explained

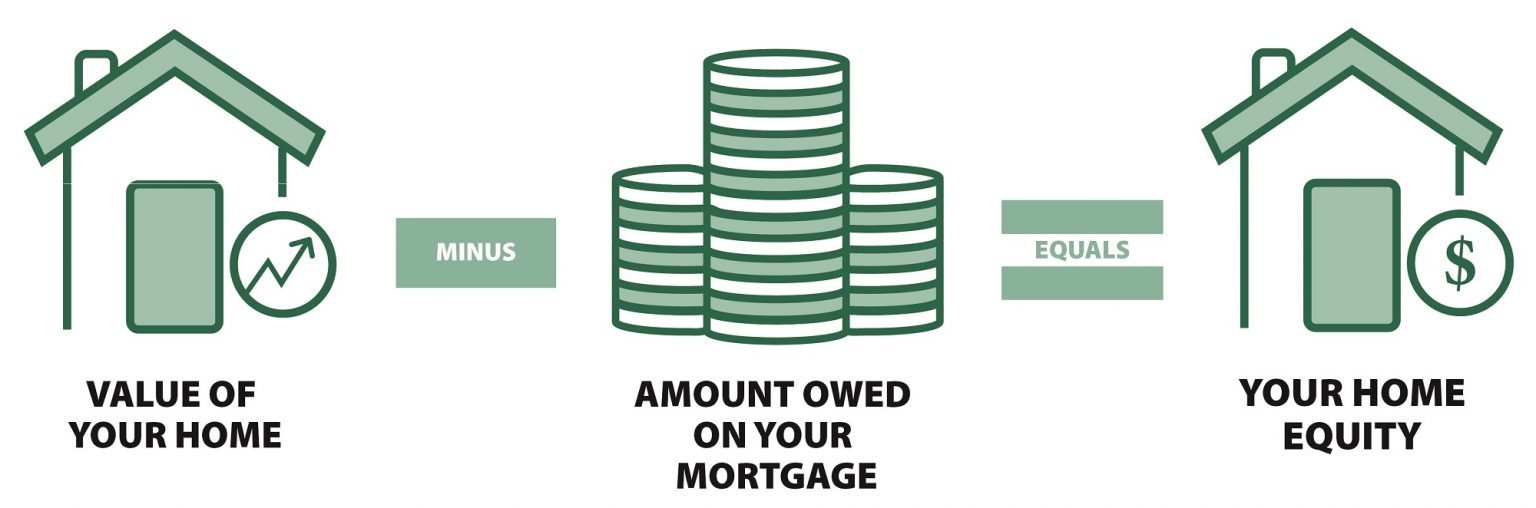

Each mortgage payment gains equity in your home — in other words, you “own” more of it.

Since houses are valuable assets, you can tap into that equity (when you have enough of it) to borrow money at a low interest rate for anything you want.

The money you borrow is called a home equity loan.

People often call home equity loans “second mortgages” because you’re taking out a brand new loan against your home.

Should I Get a Home Equity Loan?

When you have at least 20% equity in your home, need access to funds, and have enough income/assets to cover a second mortgage, then you might find a home equity loan useful.

Like any debt, home equity loans are a good idea only for certain things. Following are some ways you can use a home equity loan.

How Can I Use a Home Equity Loan?

You can use a home equity loan for whatever you want, in theory.

But some uses are better than others. Here are some ways you can use a home equity loan to improve your finances.

-

Consolidating/refinancing debt: Since your home secures your loan, you’ll get a low interest rate. This enables you to consolidate and refinance high-interest debt, like credit cards.

-

Home improvements: Home equity loans provide a low-interest method of financing repairs or remodeling.

-

Education expenses: Interest rates on home equity loans are often lower than those on private student loan rates.

-

Emergency fund: You can set aside your loan for emergencies.

-

Investments: Home equity loans be used to invest in an asset that offers a return rate higher than your loan interest rate. Remember that you can lose your money when investing, though.

How Can I Get a Home Equity Loan?

Getting a home equity loan takes some effort, but it’s much easier than getting your first mortgage on a home.

You first provide all relevant information (listed in the next section) to your lender. If you meet the lender’s requirements, they’ll schedule an appraisal of your home.

After the appraisal, the underwriter verified all information on your application, collects any more documents they need, and reviews the property appraisal, among other things.

Once you’re approved, you can sign on the dotted line and arrange for your preferred method of loan disbursal.

What Do I Need to Get a Home Equity Loan?

Like with mortgages, you must meet extensive requirements to get a home equity loan.

First of all, there are the financial requirements.

-

Credit: Home equity lenders prefer to see that you haven’t applied to new credit within the last several months. As for credit score, 620-640 is the minimum for most home equity loans. No need to send your lender a copy of your credit report, though. They can access that when they are making their lending decision.

-

Equity: You must have at least 20% equity in your house. With more equity, you can get a larger loan.

-

Debt-to-Income ratio (DTI): Your DTI measures your total monthly debt payments against your income. Home equity lenders like to see below 43%-45% DTI. Homeowners with excellent credit and sufficient cash reserves can get away with a higher DTI.

Documents you’ll need include the following.

-

Identification: A valid driver’s license can serve as identification.

-

Proof of assets: Bring two months of statements for investment accounts, IRAs, and bank Certificates of Deposit. 401(k) account holders should bring their most recent quarterly statement.

-

Proof of employment: In some cases, pay stubs can be enough to prove your employment. However, your lender may want to see a proof of employment letter from your workplace.

-

Proof of income: Pay stubs prove your employment. If you’re self-employed, bank statements and tax returns can prove your income. This helps establish your DTI. Bring proof of income for all other income sources, too.

-

Proof of insurance: Proof of homeowner’s, hazard, and flood insurance policies.

-

Proof of residence: Official correspondence addressed to your home counts as proof of residence. Examples include utility bills and bank statements.

-

Other records: Divorce, alimony payments, bankruptcy/foreclosure documents, etc.

Benefits of Getting a Home Equity Loan

Home equity loans bring you numerous advantages.

-

Low, fixed interest rates

-

Provides access to substantial cash fast

-

Home equity loan interest may be tax deductible

Why Get a Home Equity Loan Through Approved Cash?

Approved Cash makes finding lenders in your area with great home equity loan rates easy.

Just fill out our form with your name, contact information, and details about your loan (type and loan amount). Our system handles the rest for you.

We only give your home equity loan request to 3 lenders, all of which will be in your local area. That way, you won’t be bombarded with phone calls, but the lenders will still be driven to compete with each other for your business.

Ready For Your Home Equity Loan? Submit a Request and Get APPROVED TODAY!

Submitting a request on Approved Cash will not affect your credit score.