Personal Loans

Need a personal loan? Approved Cash can help you out.

What is a Personal Loan?

A personal loan is a broad type of loan that you can use for nearly anything. You repay these loans in fixed monthly payments plus interest over time.

Personal loans tend towards being shorter-term — with most maxing out at five-year term lengths. Long-term personal loans exist, but they’re uncommon and have higher interest rates.

Personal loans can either be secured or unsecured. Secured personal loans require collateral, but you usually get better interest rates and higher loan amounts. Unsecured loans can be harder to get and have higher interest rates, but no collateral is required.

What Can I Use a Personal Loan For?

Personal loans are versatile tools that, when used correctly, can improve your financial situation. Here are some ways you can use a personal loan.

- Starting a business: Most business loans require you to already be in business for a year or so and have lots of documentation. If you’re an entrepreneur who isn’t there yet, a personal loan can help you acquire funding for much less work — especially if you don’t need as much money. Just remember that your name (not your business’) is on the loan, so your personal assets and credit are at risk.

- Cars: In some cases, personal loans might be a good option for a car. This is not for everyone, though.

- Funerals: Not fun to think about, but a personal loan can provide the funding you need to commemorate a loved one’s lifetime.

- Large purchases: Personal loans can help you afford items like a new TV or piece of furniture.

- Paying off large medical bills: Healthcare bills can be expensive and sudden. If you don’t have plenty of cash to spare, a personal loan can cover your medical bills and provide you an easy monthly repayment.

- Weddings: Weddings aren’t cheap. A personal loan can stretch your wedding budget further so you can tie the knot in the exact way you dream of doing so.

Keep in mind that using debt for “wants” (such as a wedding or major purchase) isn’t always optimal. Do your best to cover some of these costs with your own funds to save on your debt interest payments.

How Do I Get a Personal Loan?

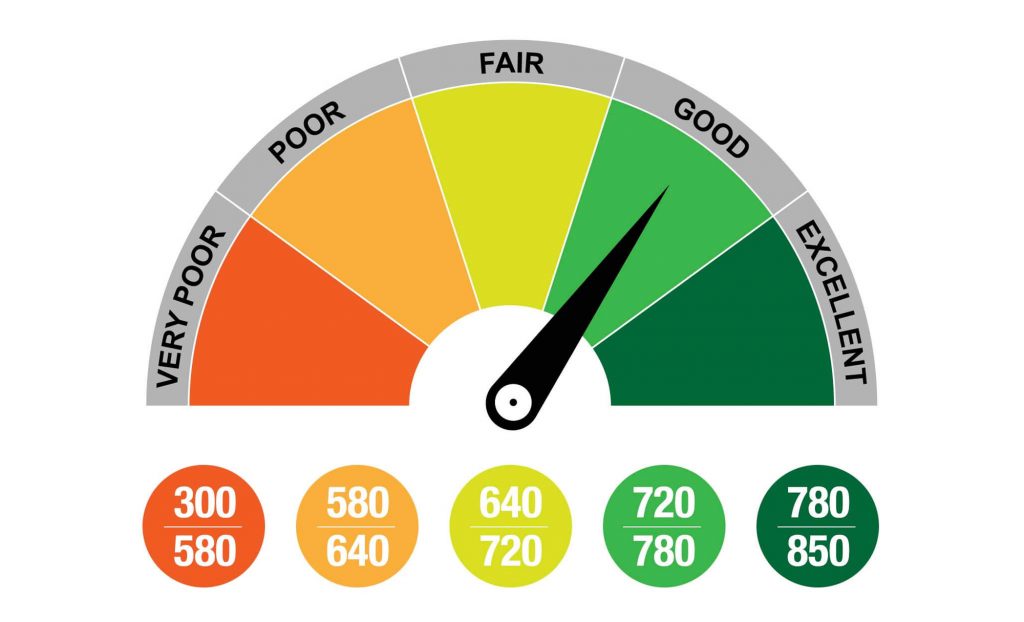

Personal loans are easy to acquire relative to other types of debt. First, determine what you want the loan for and how much you need. Also decide if you want a secured or unsecured loan. You’ll need strong credit to get an unsecured personal loan — so if your credit isn’t too great, be ready to put down collateral.

Once you’re ready to get your loan, you can head over to our system, specify that you want a personal loan, then give us the loan amount and your contact information. Our system will do the rest, matching you with a local lender within 24 hours.

Once our system finds you a local lender, you speak to the lender about your personal loan details and provide all the relevant documentation. After finalizing your loan terms with the lender, they will send the loan funds to you via check or direct deposit into your bank account — whichever way you prefer.

Now, you’re free to spend your personal loan as you wish. You’ll then start paying back your personal loan to your lender.

What Do I Need to Get a Personal Loan?

- Collateral: If you’re getting a secured loan, you need collateral. Collateral can be anything with value. A car, your home, bank accounts, investment accounts, even jewelry in some cases.

- Credit report: You don’t have to bring this, as the lender can access it from there end. Be prepared for a hard inquiry (formal credit check), though, which dings your credit score for a while.

- Identification: Usually, you’ll need two forms of government ID. Driver’s license and a utility bill are common choices.

- Proof of address: Utility bill covers this, although you can also use lease agreements, proof of insurance documents, or voter registration cards.

- Proof of income and employment: Pay stubs can cover both. So can W2 forms. Some lenders may want to see your employer’s contact details, too. If you’re self-employed, you can bring bank statements, tax returns, 1099s, and Profit & Loss statements.

Also be prepared for an origination fee. Lenders dock a small portion of your loan proceeds to cover loans processing costs. You may need to adjust your total loan amount upwards a bit to account for this fee.

Why Should I Use Approved Cash to Find a Personal Loan?

There are so many lenders out there, all trying to reel you in with amazing promises — how do you choose one?

Approved Cash takes the searching and filtering through lenders off your plate. Simply enter your name, contact information, and loan details (type and loan amount) in our form on our homepage and get that personalized loan.

We’ll take it from there. Our system will match you with the best 3 local lenders for personal loans in your area.

Why so few lenders? And why local? Well, we know how annoying it is to get 100 calls a day for months on end from lenders pushing loan offers on you. By matching you with 3 local lenders, your phone won’t be ringing off the hook.

These lenders will see you as a valued member of your community rather than some number on the other side of the country — yet they’ll still offer you great rates to compete for your business.

Personal Loan Calculator

While you are there you can use our personal loan calculator to determine your monthly payments and the total costs of your Loan Calculator with different loan options.

Ready to Get Your Personal Loan? Submit a Request and Get APPROVED TODAY!

Submitting a request on our site will not affect your credit score.